Trusting Trusts: Challenges to Trust Creations for People of Color

There are many misconceptions about wills and trusts that prevent people, especially people of color, from seeking estate planning advice. Some people think trusts are only for the wealthy or for people with children. Others think trusts are cost-prohibitive. These misconceptions account for why many people of color fail to create trusts for asset distribution upon their passing.

In this article, I’ll debunk these misconceptions and highlight additional barriers to creating trusts for people of color. I’ll also explore how lack of familiarity and trustworthiness account for why many people of color do not take advantage of our trust laws.

Debunking Misconceptions about Trusts

Trusts are a useful tool for all people with assets to protect.[1] Trusts are not limited to the wealthy or people with many assets. In fact, a trust can be created for the distribution of a single asset, which is often the case with one’s home property. Trusts also manage the distribution of personal and/or financial assets, regardless of their economic worth.

Trusts can be established to achieve a variety of goals. For example, trusts are often created to avoid the distribution of assets in probate court. Probate court is costly and delays the distribution of one’s assets. Similarly, trusts instruct to whom assets are distributed, rather than having assets automatically distributed to one’s heirs, per the laws of intestacy. Trusts also work to minimize estate taxes upon the trustor’s death, thereby making sure beneficiaries receive as much of your money as possible.

Trusts are not limited to people with children. While a majority of trusts disburse assets to children or other family members, a great number of trusts instruct assets be distributed to charitable organizations.

Trusts should not be cost-prohibitive to create. While complex estates tend to be more time consuming, and thus increase the legal fees, the majority of trusts are straightforward and do not break the bank. Moreover, the legal fees associated with trust creation are often much less than the expense of probate court.

As an estate planner, I provide free consultations. I explain the benefits and values of estate planning and how important it is for overall future planning.

Cultural Barriers to Trust Creation for People of Color

In the United States, far too many immigrants and people of color die without a trust.[2]

Trusts can be traced back to 13th century England, when the Magna Carta was created, and is rooted in common law. Only one-third of the world’s population live in common law jurisdictions or in countries where common law is mixed with civil law.[3]

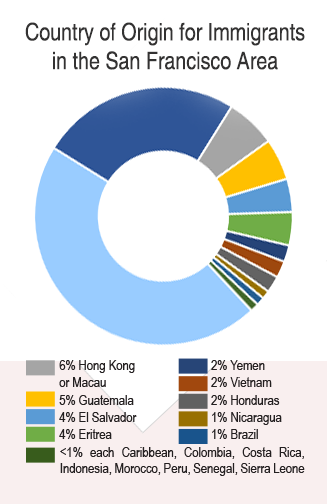

In the United States, the majority of immigrants come from countries that do not practice Common Law.[4] The graph below shows the country of origin for immigrants in the San Francisco Area.[5] Hong Kong, of which 6 percent of San Francisco immigrants come from, is the only country that has a system based on English Common Law.

Thus, the benefits of trusts are not commonly known by first generation immigrants who have not previously dealt with similar estate planning issues in their home country. This unfamiliarity prevents immigrants from setting up their own estate plan for their children. Similarly, children learn from their parents about financial and health related matters. Immigrant parents, unfamiliar with estate planning themselves, fail to pass on to their children the value—both financial and otherwise—of creating a trust.

For example, there is no probate law in Japan. As such, Japanese immigrants may not know about setting up a trust to avoid probate in the U.S. Similarly, Japanese immigrants may not pass along to their children information concerning the benefits of trust creation over probate.

Education and outreach to immigrant communities about estate planning and trust law would benefit all communities of color and better preserve assets for their heirs.

The Importance of Trustworthiness

The relationship between an attorney and client requires a high level of trustworthiness before engagement. The information disclosed is of high confidence and clients often seek legal advice when they are most vulnerable. Clients are most comfortable entering into this relationship if they feel connected on some level to the attorney. Thus, many people of color are hesitant to engage in a legal relationship with an attorney that shares little to no cultural or linguistic similarities with them.[6]

As an attorney, people seek me out not just for my knowledge, experience and personalized service, but also for additional value I bring to the relationship as a woman of color. One client, a Filipino woman, shared that she felt immediately at ease with me because we communicated in Tagalog, her native language. She also felt I could relate and understand her better than other attorneys due to my gender, heritage and language skills.

Another factor that contributes to a lack of trustworthiness is the racial injustice prevalent throughout our criminal justice system. This racial injustice often permeates to the civil justice system as well. As such, it is not surprising that many people of color are hesitant to seek legal services to create trusts.

Education, outreach and having an attorney that shares some common background, whether it’s gender, cultural, linguistic, or experiential is critical to better assist people of color with estate planning services and asset protection for their heirs.

[1] Lacey Kessler, Survey: Half of America Sees Estate Planning As Tool of the Ultra Rich, https://www.thewealthadvisor.com/article/survey-half-america-sees-estate-planning-tool-ultra-rich (last visited May 12, 2021).

[2]Earl G. Graves, Sr., Lack of Estate Planning Puts Black Wealth At Risk, November 2015, https://www.blackenterprise.com/lack-of-estate-planning-puts-black-wealth-at-risk/ (last visited May 12, 2021).

[3] These populations include the people of Antigua and Barbuda, Australia, Bahamas, Bangladesh, Barbados, Belize, Botswana, Burma, Cameroon, Canada (both the federal system and all its provinces except Quebec), Cyprus, Dominica, Fiji, Ghana, Grenada, Guyana, Hong Kong, India, Ireland, Israel, Jamaica, Kenya, Liberia, Malaysia, Malta, Marshall Islands, Micronesia, Namibia, Nauru, New Zealand, Nigeria, Pakistan, Palau, Papua New Guinea, Philippines, Sierra Leone, Singapore, South Africa, Sri Lanka, Trinidad and Tobago, the United Kingdom (including its overseas territories such as Gibraltar), the United States (both the federal system and 49 of its 50 states), and Zimbabwe.

[4]https://www.cia.gov/the-world-factbook/field/legal-system/

[5]The San Francisco Integration Project. The San Francisco Immigrant Integration Project: Findings from Community-Based Research Conducted by the San Francisco Immigrant Legal & Education Network (SFILEN) San Francisco Immigrant Legal & Education Network (SFILEN) 2014, https://repository.usfca.edu/cgi/viewcontent.cgi?article=1007&context=mccarthy_fac (last visited May 12, 2021).

[6]See Tsedale M. Melaku, Why Women and People of Color In Law Still Hear “You Don’t Look Like a Lawyer,” https://hbr.org/2019/08/why-women-and-people-of-color-in-law-still-hear-you-dont-look-like-a-lawyer (last visited May 12, 2021).